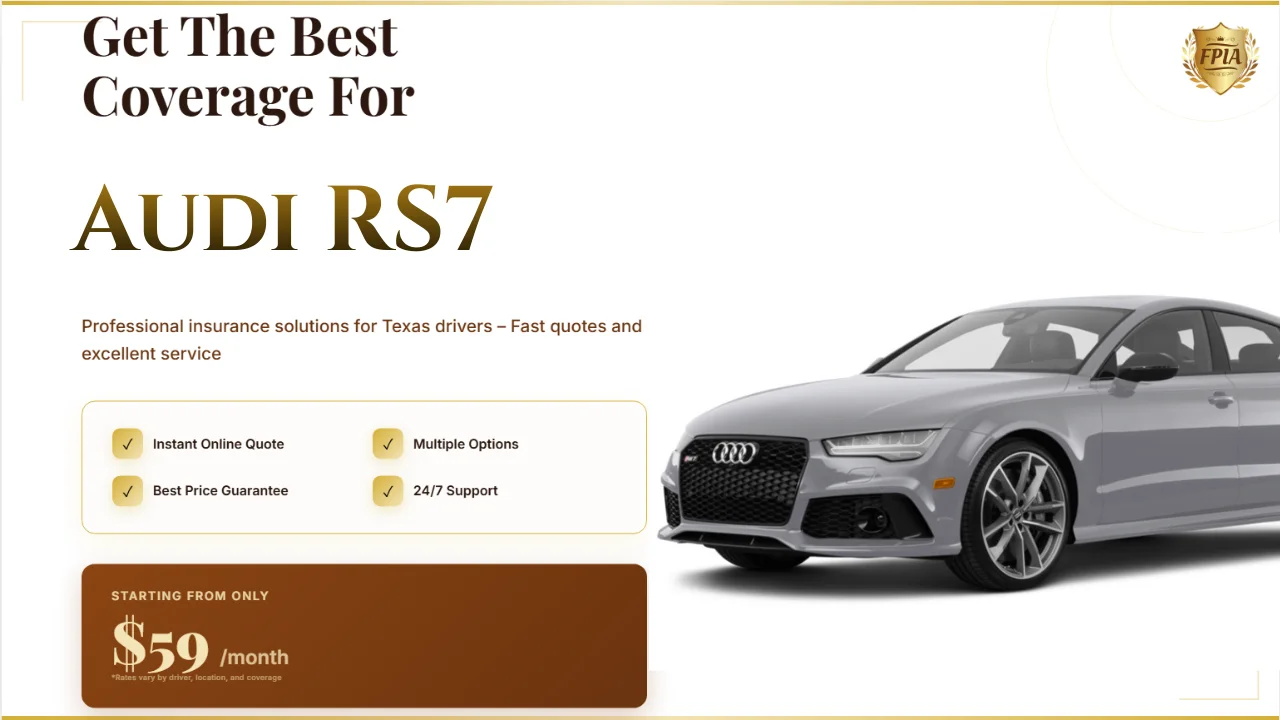

Best Audi RS7 Insurance in Texas: Get Instant Quote

Published: January 28, 2026

When it comes to insuring your Audi RS7 in Texas, finding the best coverage is essential to protect both your luxury vehicle and your peace of mind. The Audi RS7 is a high-performance car that demands the right insurance to keep it covered in every driving situation, from city streets to Texas highways. But the question arises—how do you secure the best insurance without breaking the bank? In this guide, we’ll take a close look at the factors that affect Audi RS7 insurance costs in Texas and provide a step-by-step action plan to get you the best quote possible.

Why Cheap Audi RS7 Insurance Might Not Be the Best Choice

It can be tempting to go for the lowest quote when insuring your Audi RS7. After all, who doesn’t want to save money? However, there are significant risks associated with opting for cheap insurance, especially for a high-value car like the RS7:

- Limited Coverage: Low-cost insurance policies often only cover the minimum required by law. While this may seem affordable, it can leave you vulnerable in case of an accident or damage. For an Audi RS7, you want more than just the bare minimum to protect your car’s high repair costs.

- Higher Deductibles: Many cheap policies come with high deductibles, meaning you’ll pay more out of pocket when you need to file a claim. This can be especially problematic if your Audi RS7 requires expensive repairs.

- Poor Customer Service: Affordable insurance providers may cut corners on customer service, which can lead to delayed claims, a lack of support, or difficulty when it comes to getting assistance in the event of an accident.

The Importance of Comprehensive Coverage for Your Audi RS7

For a car as luxurious and powerful as the Audi RS7, it’s crucial to go beyond the basics and consider comprehensive insurance coverage. Here’s why:

- Protection from Accidents: Whether you're driving through downtown Austin or taking a road trip through Texas, accidents happen. Comprehensive insurance will cover the cost of repairs and medical bills, even in the event of an accident caused by another driver.

- Theft Protection: Audi RS7s are high-end vehicles, making them attractive targets for theft. With comprehensive coverage, you’ll be reimbursed if your car is stolen, which can save you from significant financial loss.

- Natural Disasters: Texas is no stranger to extreme weather conditions, including hailstorms, floods, and hurricanes. Comprehensive coverage protects your vehicle from damage caused by natural disasters that could severely impact your car.

Step-by-Step Action Plan for Getting the Best Audi RS7 Insurance in Texas

To make sure you get the best coverage for your Audi RS7, follow this actionable plan:

Step 1: Understand Your Coverage Needs

Before you start comparing quotes, take the time to assess your needs. Consider factors like:

- Driving Habits: If you frequently drive long distances or at high speeds, you may need more coverage. Consider increasing your liability limits and adding accident forgiveness if you're a high-mileage driver.

- Location: Where you live in Texas plays a big role in your insurance costs. For example, cities like Houston have higher rates of car theft and accidents, so you may need additional protection against these risks.

- Your Budget: While it’s tempting to look for the cheapest option, make sure you're balancing cost with the level of coverage. You don’t want to be underinsured, especially with a high-value car like the Audi RS7.

Step 2: Compare Insurance Quotes

Now that you understand your needs, it’s time to start shopping around for quotes. When comparing, look for insurers that offer the best combination of price and coverage. Key providers for Audi RS7 insurance in Texas include:

- Geico: Geico is known for its competitive rates and extensive coverage options, including for luxury cars like the Audi RS7. They offer various discounts and reliable customer service.

- Progressive: Progressive allows you to customize your insurance policy, making it a great option for those who need tailored protection for their RS7. They also offer discounts for safe drivers and vehicles equipped with advanced safety features.

- State Farm: State Farm is one of the most trusted names in car insurance, and they offer robust coverage options, including collision, comprehensive, and liability coverage, along with excellent customer service.

- Allstate: Allstate offers comprehensive coverage for luxury vehicles like the Audi RS7. They provide perks like accident forgiveness and new car replacement, which can be a great addition for RS7 owners.

Step 3: Consider Additional Coverage Options

In addition to the standard coverage, consider these optional add-ons to fully protect your Audi RS7:

- Roadside Assistance: Roadside assistance is a must-have for any Audi owner. This coverage will ensure that you have access to help in case you break down or need a tow.

- Gap Insurance: If your Audi RS7 is totaled in an accident, gap insurance will cover the difference between the car’s value and the amount you owe on your loan, preventing you from having to pay out of pocket for the remaining balance.

- Rental Car Coverage: If your RS7 is in the shop for repairs, rental car coverage will provide you with a temporary vehicle so you’re not left without transportation.

[Get Your Audi RS7 Insurance Quote Now]

Top Insurance Providers for Your Audi RS7 in Texas

After comparing quotes and evaluating your needs, it's time to choose the best provider. Here are some top insurers for Audi RS7 owners in Texas:

- Geico: Known for affordable rates and great customer service, Geico is a reliable choice for Audi RS7 insurance. They also offer discounts for bundling multiple policies.

- Progressive: Progressive is another top choice for those seeking a customizable insurance policy. They offer comprehensive protection tailored to your needs.

- State Farm: State Farm is a solid choice for those who value excellent customer service and extensive coverage options for their Audi RS7.

- Allstate: Allstate’s added perks, such as new car replacement and accident forgiveness, make them a strong contender for Audi RS7 insurance in Texas.

Why Skimping on Insurance for Your Audi RS7 Can Be a Costly Mistake

While it may seem like a good idea to opt for the cheapest Audi RS7 insurance, it’s important to remember that cutting corners can lead to major financial consequences. A higher premium with better coverage is a small price to pay to protect your luxury vehicle. Comprehensive coverage not only ensures you’re protected in the event of an accident or theft but also gives you peace of mind knowing that your Audi RS7 is in good hands.

FAQ - Frequently Asked Questions

How much does Audi RS7 insurance cost in Texas?

The average cost of insuring an Audi RS7 in Texas ranges from $2,000 to $3,500 per year, depending on factors such as your driving history, location, and chosen coverage levels.

Can I get discounts on Audi RS7 insurance?

Yes, many insurance companies offer discounts for safe driving, bundling multiple policies, and installing safety features in your vehicle. Be sure to ask your insurer about any available discounts.

Is full coverage necessary for my Audi RS7?

Yes, full coverage is highly recommended for luxury vehicles like the Audi RS7. It provides protection against accidents, theft, and other risks that could lead to significant financial loss.