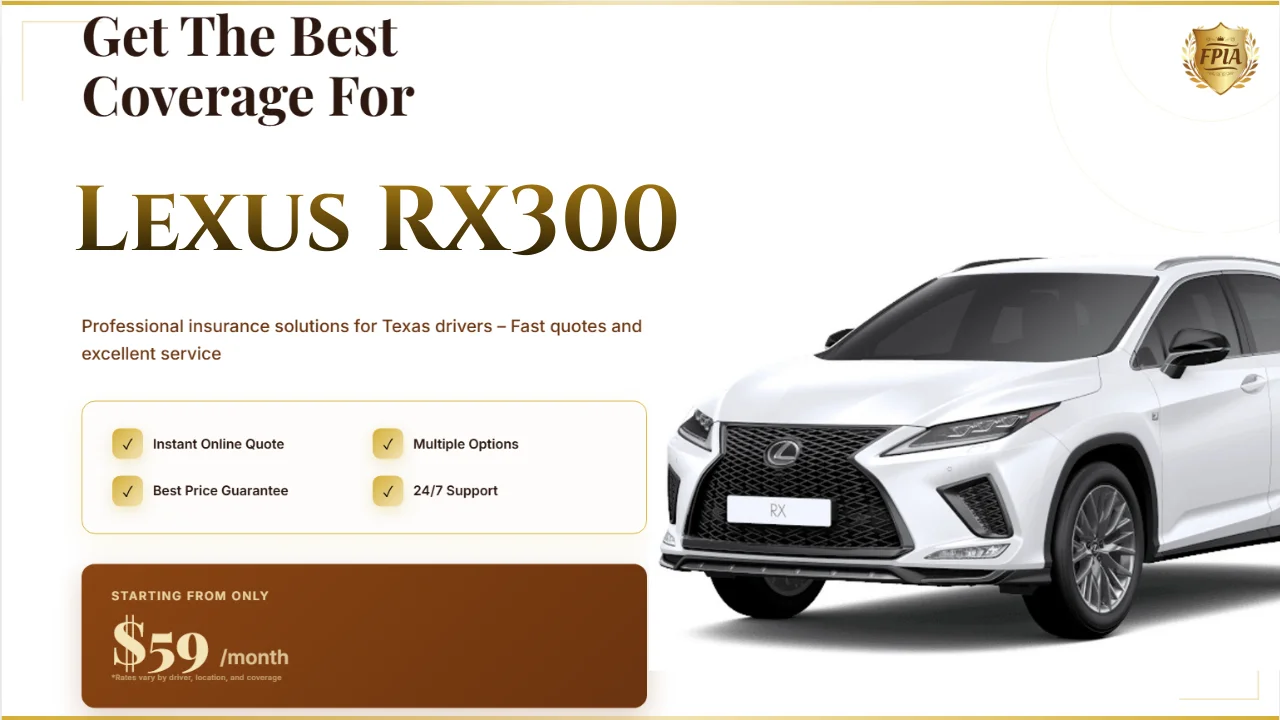

Best Lexus RX300 Insurance in Texas: Get Instant Quote

Published: January 28, 2026

Owning a Lexus RX300 in Texas is a testament to appreciating reliability and luxury. This vehicle, often credited with starting the luxury crossover segment, remains a popular choice on Texas highways due to its durability and comfort. However, navigating the insurance landscape for an older luxury vehicle can be confusing. Many drivers ask themselves: "Am I paying too much for a car that is 15 or 20 years old?" or "Do I really need full coverage on a vehicle with this mileage?"

The reality is that Texas auto insurance rates have been climbing steadily, and owners of older luxury SUVs are not exempt from these hikes. Whether you are driving through the busy streets of Houston, navigating the traffic in Dallas, or commuting in San Antonio, finding the best Lexus RX300 insurance in Texas requires a strategic approach. It is not just about finding the cheapest number; it is about finding a policy that actually protects you without draining your wallet. You need to balance the mandatory state liability requirements with the actual cash value of your car. In this deep-dive Q&A session, we will answer the most pressing questions regarding coverage, costs, and how to secure an instant quote that fits your budget.

Question 1: Why Do Insurance Rates for the Lexus RX300 Vary So Much in Texas?

One of the most common frustrations for Texas drivers is seeing a wide disparity in price quotes for the exact same vehicle. You might talk to a neighbor who pays $50 a month for their RX300, while your quote comes in at $120. Why does this happen? The answer lies in the complex algorithm insurance companies use to determine risk. It is rarely just about the car; it is about the driver profile and the specific location.

Firstly, location plays a massive role. In Texas, insurance is regulated by zip code. If you live in a high-density area like Harris County or heavily trafficked zones in Austin, your rates will naturally be higher than someone living in a rural county. This is due to the statistical probability of accidents, theft, and vandalism. The Lexus RX300, while not a top target for theft compared to pickup trucks, still incurs costs if parts need to be sourced for repairs. While the car is older, "Lexus" still implies "luxury," and some insurers inflate premiums anticipating higher labor costs for repairs.

Secondly, your credit history is a significant factor in Texas. Insurers use an "insurance score" which is heavily weighted by your credit rating. Statistics show that drivers with lower credit scores are more likely to file claims. Therefore, if your credit has taken a hit recently, you might see a spike in your premiums, even if you have a clean driving record. Conversely, maintaining a high credit score can unlock the cheapest liability rates available.

Finally, the age of the vehicle creates a variance in how carriers view it. Some major carriers view older vehicles as a liability because safety features (like automatic braking or lane assist) found in modern cars are missing. However, specialized agencies often view the RX300 as a safe, low-risk "commuter" vehicle, offering significantly better rates. This is why shopping around and comparing instant quotes is non-negotiable.

Question 2: Should I Carry Full Coverage or Liability Only on an Older Lexus?

This is perhaps the most critical financial decision you will make regarding your auto policy. The Lexus RX300 is a durable machine, but as it ages, its Actual Cash Value (ACV) depreciates. This creates a dilemma: is it worth paying for Comprehensive and Collision coverage (Full Coverage), or should you switch to Liability Only?

When to choose Liability Only: If your RX300 has high mileage and a market value below $3,000 or $4,000, paying $1,000 a year for full coverage may not make financial sense. In the event of a total loss, the insurance company will only pay the current market value, minus your deductible. If that payout is minimal, you are essentially throwing money away on premiums. Liability coverage meets the Texas state legal requirements (currently 30/60/25) and protects you if you damage someone else's property or cause bodily injury.

When to keep Full Coverage: However, do not be too quick to drop coverage if you cannot afford to replace the vehicle immediately. If this is your only mode of transportation and you do not have savings to buy another car if you crash, Full Coverage acts as a safety net. Additionally, Texas weather is unpredictable. Hail damage is a common occurrence. Comprehensive coverage pays for non-collision events like hail, flood, fire, or theft. If you live in an area prone to severe storms, retaining comprehensive coverage (perhaps with a higher deductible to lower the cost) might be a smart move.

Ultimately, the "10% Rule" is a good benchmark. If the annual cost of full coverage exceeds 10% of your car's total value, it is usually time to switch to liability. Always consult with a licensed agent who can run the numbers for your specific situation.

Question 3: How Do Accidents, Tickets, and SR22s Impact My Options?

Life happens. Sometimes you get a speeding ticket, or worse, you are involved in an at-fault accident or receive a DUI. For Lexus RX300 owners in this position, the concern shifts from "getting the best deal" to "getting insured at all."

The Impact of Traffic Violations

A single speeding ticket can raise your rates by 15-20% in Texas. An at-fault accident can spike them by 40% or more. If you fall into this category, standard carriers might drop you or quote astronomical prices. This is where non-standard insurance markets come into play. These providers specialize in high-risk drivers and can offer affordable coverage for your Lexus, allowing you to get back on the road legally.

Understanding Texas SR22 Requirements

If your license has been suspended due to a DWI, driving without insurance, or too many traffic violations, the state of Texas will require you to file an SR-22 Financial Responsibility Certificate. Many drivers mistakenly think this is a type of insurance; it is actually a document your insurance company files with the DPS to prove you have active coverage.

Not all companies offer SR22 filings. If you need an SR22 for your RX300, you need a specialized agency. The good news is that because the RX300 is an older vehicle, the base rate for the car itself is low, which helps offset the high-risk surcharge of the SR22. Do not let the fear of high costs keep you from driving legally; there are agencies dedicated to finding the lowest rates for SR22 insurance in Texas.

Question 4: Where is the Best Place to Get a Quote? (Reviews & Trusted Address)

In the digital age, you have two choices: use a faceless online comparison tool that sells your data to a dozen spam callers, or work with a local, licensed independent agency. The latter is almost always the superior choice for Texas drivers.

Independent agencies have access to multiple carriers—not just one. They can compare rates from various companies to find the specific insurer that offers the best rate for a Lexus RX300 in your zip code. They understand the nuances of Texas law, from minimum liability limits to Uninsured Motorist Protection (which is highly recommended given the number of uninsured drivers in Texas).

We highly recommend seeking out agencies that have a physical presence and a track record of customer service. Look for agencies that specialize in both standard and non-standard auto insurance. They are best equipped to handle older luxury vehicles and drivers with diverse driving histories.

Fully Protected Insurance is a prime example of a trusted local resource. With a focus on finding the most competitive rates for Texas drivers, they can navigate the complexities of insuring older vehicles like the RX300. Whether you need basic liability to get your tags or full coverage for peace of mind, their team creates a tailored solution.

[Get Your Instant Lexus RX300 Quote Here]

Question 5: Action Plan - What Should I Do Right Now?

Waiting is the enemy of savings. Insurance rates are fluctuating constantly, and if your current policy is up for renewal soon, you are likely about to see a rate increase. Do not wait for the renewal notice to land in your mailbox before you take action.

Your Checklist:

- Check your current policy declaration page to see your limits and deductibles.

- Assess the condition and mileage of your Lexus RX300.

- Decide if you need SR22 filing or if you qualify for "Good Driver" discounts.

- Click the link above or contact a local agent immediately to compare.

Securing the best insurance is about being proactive. By getting an instant quote today, you lock in the best possible price and ensure that you and your Lexus are covered against the unexpected.

Question 6: FAQ - Common Questions About Lexus RX300 Insurance

Is the Lexus RX300 considered a sports car for insurance purposes?

No, the Lexus RX300 is classified as a luxury crossover SUV. It is generally not flagged as a "sports car" by insurance companies, which helps keep premiums lower than high-performance coupes. However, because it is a luxury brand, parts can be slightly more expensive than a standard Toyota, which affects collision repair estimates.

Can I insure my Lexus RX300 in Texas without a driver's license?

Yes, it is possible, though more difficult. Some insurance carriers in Texas accept a valid foreign passport, a Matricula Consular, or an International Driver’s Permit (IDP) to issue a policy. You will typically need to list a licensed driver on the policy or exclude yourself from driving until you obtain a license, depending on the carrier's specific rules.

Does my Lexus RX300 need a specific alarm system for a discount?

Most Lexus RX300 models came with factory-installed anti-theft systems, which already qualify you for a discount. However, verifying this with your agent is crucial. If you have added an aftermarket GPS tracker or kill switch, be sure to mention it, as this can further lower your comprehensive coverage premium.