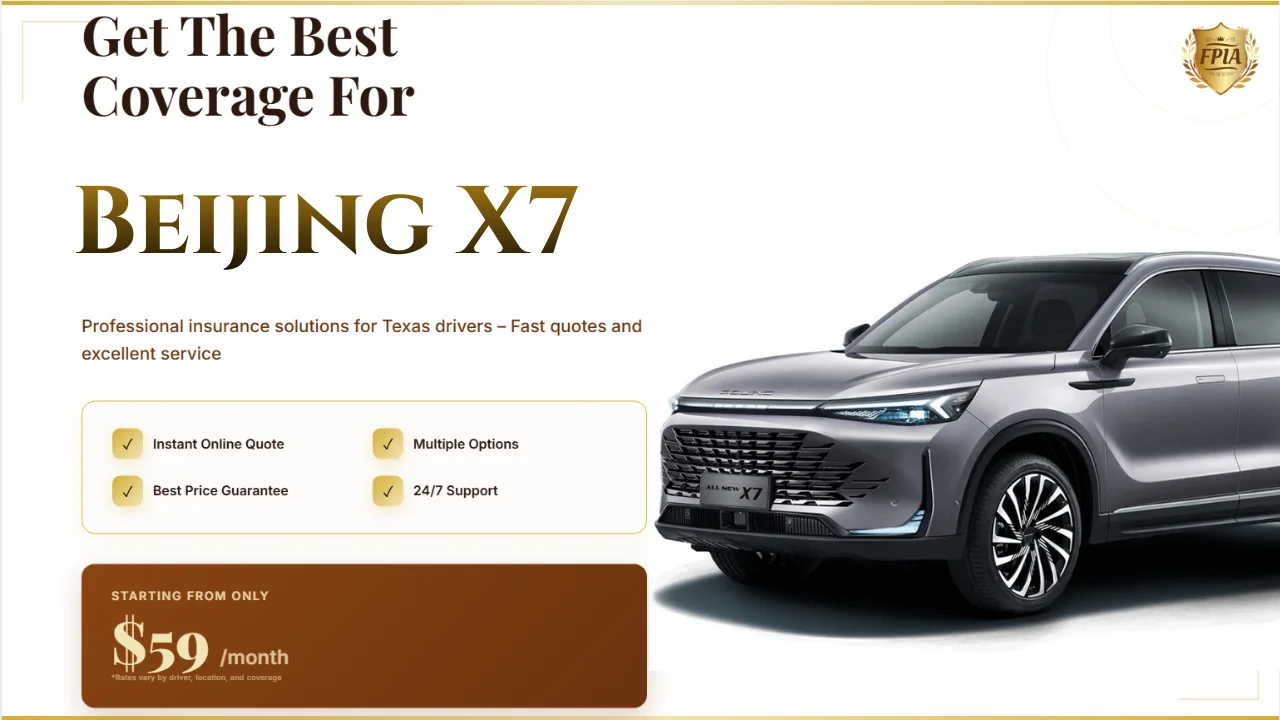

Cheap Beijing X7 Insurance Texas: SR22 & No License OK

Published: January 28, 2026

Searching for Cheap Beijing X7 Insurance Texas usually means one thing: cost pressure. Drivers are comparing numbers, calculating monthly payments, and trying to stay legal with SR22 or no-license situations without blowing their budget. Data shows that the cheapest option on paper is rarely the cheapest over time. This analysis breaks down real cost drivers, compares options, and shows how to reduce risk while keeping premiums under control.

What Actually Drives the Cost of Beijing X7 Insurance in Texas?

When people search for Cheap Beijing X7 Insurance Texas, they often assume price is based only on the car. In reality, insurers use layered data models. Vehicle value is just one variable.

The Beijing X7 is a newer SUV model, which places it in a higher repair-cost category. Parts availability, labor familiarity, and technology features all influence premiums. Statistically, newer vehicles cost more to insure than older compact sedans.

Driver history weighs even more. Tickets, accidents, lapses in coverage, and SR22 requirements can double or triple base rates. No-license cases add underwriting restrictions that further narrow cheap options.

Geography also matters. Texas zip codes with higher claim frequency see higher averages, regardless of vehicle brand.

Is Cheap Beijing X7 Insurance With SR22 Really Possible?

Yes, but the data shows a clear tradeoff. SR22 policies cost more because they flag high-risk status. According to industry averages, SR22 filings increase premiums by 40–70 percent compared to standard policies.

The biggest cost mistake is policy instability. Cheap insurers may cancel or re-rate SR22 policies after filing, leading to reinstatement fees and coverage gaps. Each lapse increases future premiums.

The cost-efficient approach is stability. Paying slightly more for a carrier experienced with SR22 often reduces total cost over the required filing period.

How Does No-License Insurance for Beijing X7 Compare by Policy Type?

No-license insurance is legal in Texas under specific structures, but pricing varies widely.

Owner Policies With Exclusions

Owner policies excluding the unlicensed driver are often the lowest-cost way to insure a Beijing X7. Data shows these can be 25–35 percent cheaper than open-driver policies.

Named Driver Policies

Adding a licensed household driver increases cost but improves claim acceptance. These policies reduce denial risk, which can save money after an accident.

Non-Owner SR22 Policies

For compliance only, non-owner SR22 insurance is statistically the cheapest option. However, it provides no vehicle coverage and should not be mistaken for full protection.

Minimum Coverage vs Full Coverage: A Cost Comparison

Minimum liability meets Texas legal requirements, but numbers show it carries higher long-term risk. A single at-fault accident can result in out-of-pocket costs exceeding years of premium savings.

Full coverage for a Beijing X7 costs more upfront, but it caps financial exposure. Collision and comprehensive claims are more frequent with newer SUVs, especially in hail-prone Texas regions.

A balanced approach uses higher deductibles to reduce premiums while keeping core protections intact. Data supports deductible optimization as one of the most effective cost-saving strategies.

Where Data Shows the Best Value for Cheap Beijing X7 Insurance Texas

Independent agencies outperform single-carrier platforms in complex cases. By comparing multiple underwriting models, they find pricing gaps that direct insurers miss.

Licensed Texas agencies also reduce error rates in SR22 filings and no-license policies. Fewer errors mean fewer penalties and lower total cost over time.

View affordable Beijing X7 insurance quotes in Texas

CTA: Use Numbers, Not Ads, to Choose Cheap Insurance

Cheap Beijing X7 Insurance Texas should be measured by total cost over time, not the first monthly quote. Compare stability, filing accuracy, and coverage limits to avoid expensive surprises.

FAQ – Cheap Beijing X7 Insurance Texas

Is Beijing X7 insurance expensive compared to other SUVs?

It is slightly higher than older SUVs but comparable to other new compact SUVs in Texas.

Does SR22 always mean very high premiums?

SR22 increases cost, but choosing the right carrier can limit the increase.

Can I insure a Beijing X7 without a driver’s license?

Yes, with properly structured owner or named-driver policies.

What is the biggest data-backed mistake when buying cheap insurance?

Choosing unstable low-price policies that cause lapses and long-term premium increases.