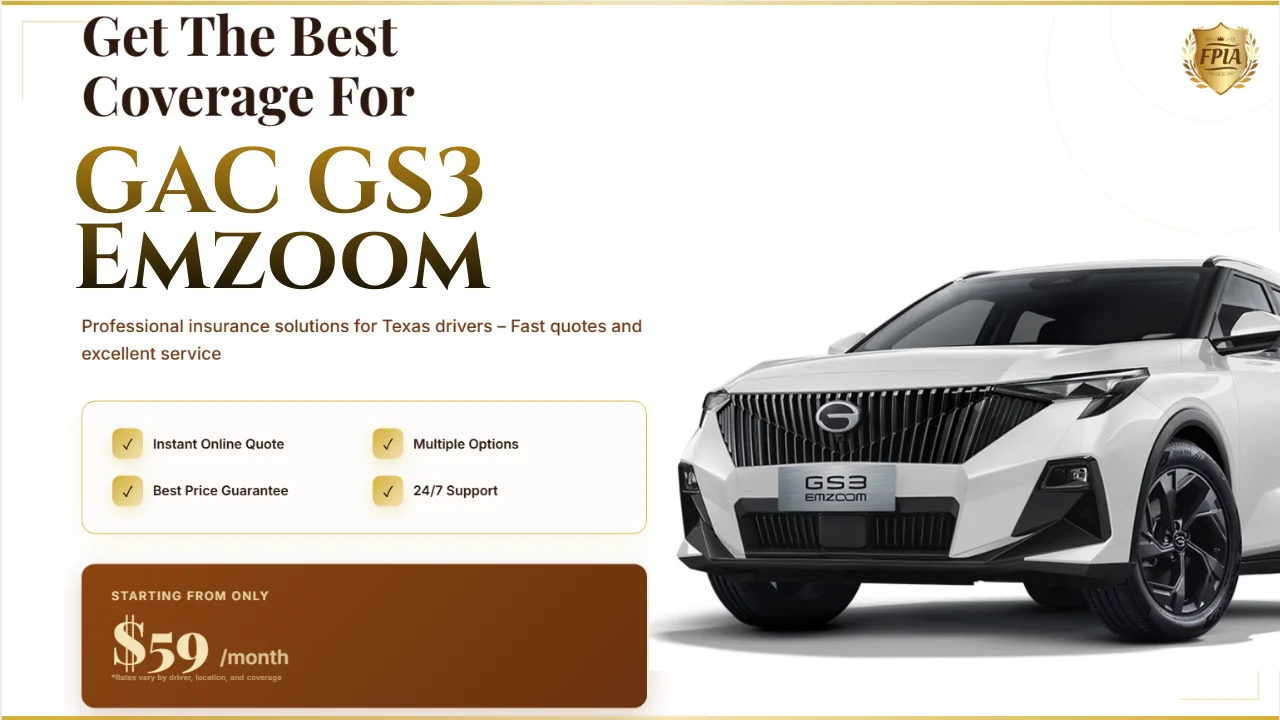

Cheap GAC GS3 Emzoom Insurance Texas: SR22 & No License OK

Published: January 28, 2026

I recently helped a first-time Texas driver who had just purchased a GAC GS3 Emzoom and needed Cheap GAC GS3 Emzoom Insurance Texas fast. The situation was complicated by an SR22 requirement and the fact that the owner did not currently hold a valid driver’s license. Like many people in this position, the instinct was to grab the cheapest quote online and hope for the best. As an insurance agent, I have seen how that decision often backfires. This guide is written from the perspective of walking that specific driver through what actually works in Texas and what mistakes to avoid.

Understanding the Real Cost of Insuring a GAC GS3 Emzoom in Texas

The GAC GS3 Emzoom is still relatively new to many Texas insurers.

Newer models often lack long-term claims data.

Limited data increases perceived risk.

Higher perceived risk affects base premiums.

Cheap policies usually offset this risk by reducing coverage.

That trade-off matters more than most drivers realize.

An Insider Look at Why “Cheap” Insurance Can Be Misleading

As an agent, I often review policies that look affordable on paper.

Many of them hide limitations in the fine print.

Lower premiums may mean higher deductibles.

Some exclude certain types of damage.

Others restrict repair options.

For a GS3 Emzoom, parts availability can already be a challenge.

How Texas Driving Conditions Affect GS3 Emzoom Insurance

Texas is not an easy state for vehicles.

Hail storms cause frequent comprehensive claims.

Urban traffic increases collision risk.

Highway speeds raise accident severity.

Heat impacts electronics and interior components.

Cheap insurance often underestimates these exposures.

SR22 GAC GS3 Emzoom Insurance Texas Explained by an Agent

SR22 is commonly misunderstood.

It is a filing, not a special insurance policy.

The state of Texas requires proof of continuous coverage.

The obligation follows the driver, not the vehicle.

Any lapse restarts the SR22 timeline.

Cheap policies increase lapse risk due to strict billing rules.

Common SR22 Mistakes I See

- Choosing insurers with unstable billing systems

- Missing payments to save short-term money

- Switching policies without transferring the SR22 filing

No License GAC GS3 Emzoom Insurance in Texas: What Actually Works

Texas allows vehicle owners to insure cars without a license.

A licensed primary driver must be listed.

Vehicle usage must be disclosed accurately.

Ownership details must match registration records.

Cheap insurers often misclassify these policies.

Misclassification can result in denied claims.

Coverage Options for the GAC GS3 Emzoom

Minimum Liability Coverage

This option meets Texas legal requirements.

It has the lowest monthly cost.

It does not cover damage to your own vehicle.

Financial risk remains entirely with the owner.

Liability Plus Comprehensive

This covers theft, fire, vandalism, and weather damage.

It is important in hail-prone Texas regions.

Premiums are moderately higher.

It balances cost and protection.

Full Coverage With Collision

This is the highest-cost option.

It covers at-fault accidents and vehicle repairs.

Recommended for newer or financed GS3 Emzoom models.

Reduces long-term financial exposure.

When Cheap GAC GS3 Emzoom Insurance Can Make Sense

Drivers with low annual mileage reduce risk.

Garage-kept vehicles lower comprehensive claims.

Clean driving records improve underwriting.

Higher deductibles paired with savings discipline help.

Bundling auto policies can lower total cost.

Why a Licensed Texas Insurance Agency Makes a Difference

Licensed agencies understand Texas compliance rules.

They file SR22 documents correctly.

They structure no license policies legally.

They compare multiple carriers objectively.

This prevents gaps hidden behind cheap quotes.

Local Support and Claims Guidance

Local agencies provide real support after accidents.

They assist with claims documentation.

They explain repair options clearly.

They advocate for proper settlements.

This support is rarely available with bare-bones policies.

View GAC GS3 Emzoom insurance quotes in Texas

Action Steps to Lower GS3 Emzoom Insurance Costs Safely

Maintain continuous coverage.

Avoid late or missed payments.

Select deductibles based on realistic savings.

Limit annual mileage when possible.

Review your policy every year.

FAQ: Cheap GAC GS3 Emzoom Insurance Texas

Is GAC GS3 Emzoom insurance expensive in Texas?

Costs can be higher due to limited claims data and repair considerations.

Does SR22 significantly increase GS3 Emzoom insurance cost?

It adds risk but can be managed with proper policy structure.

Can I insure a GS3 Emzoom without a license in Texas?

Yes, if a licensed primary driver is correctly listed.

Is liability-only coverage enough for a GS3 Emzoom?

It meets legal rules but exposes the owner to major financial risk.