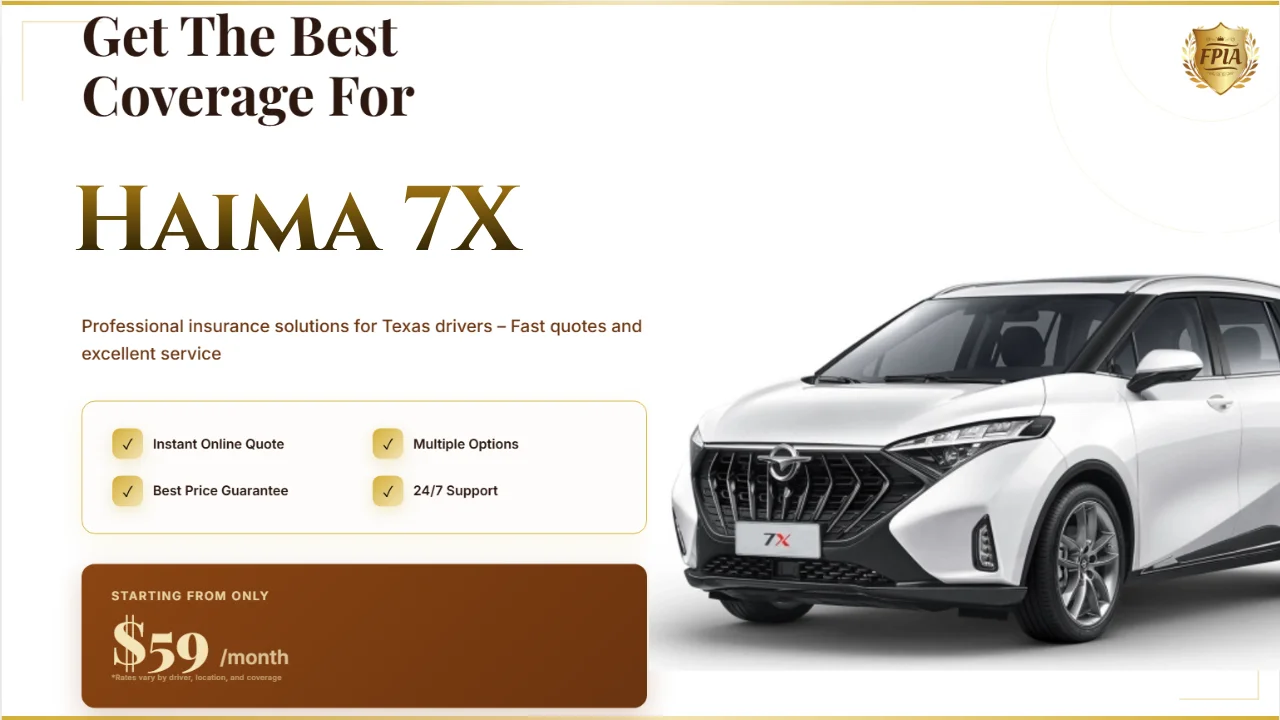

Cheap Haima 7X Insurance Texas: SR22 & No License OK

Published: January 28, 2026

Shopping for Cheap Haima 7X Insurance Texas can feel confusing, especially when SR22 requirements or a no-license situation are involved. From an insider insurance agent perspective, the biggest cost differences usually come from how policies are structured, not from the vehicle itself. Understanding the numbers behind coverage, risk, and discounts helps drivers avoid overpaying while staying compliant on Texas roads.

What Do the Numbers Say About Haima 7X Insurance Costs in Texas?

The Haima 7X falls into the family MPV category.

Statistically, this segment has lower claim severity than sports sedans.

Texas insurers rate it closer to mid-size SUVs.

This keeps base premiums more affordable.

Cost differences mainly come from driver history.

How Texas Driving Data Impacts Your Premium

Texas insurers heavily weigh mileage and accident frequency.

Urban areas see higher claim rates.

Suburban family vehicles like the Haima 7X benefit from this data.

Lower theft statistics also help reduce comprehensive costs.

Which Coverage Types Offer the Best Value?

From an agent standpoint, value matters more than minimum price.

Each coverage tier has clear cost-benefit math.

State Minimum Liability

This option meets legal requirements.

It is the cheapest monthly choice.

It offers no protection for the Haima 7X itself.

Liability Plus Comprehensive

This covers theft and weather damage.

Texas hail claims make this popular.

Premium increases are usually moderate.

Full Coverage With Collision

This option protects against at-fault accidents.

Recommended for newer Haima 7X models.

Often required by lenders.

How SR22 Changes the Cost Equation

SR22 is often misunderstood.

It is a filing, not a special policy.

The cost increase reflects risk, not paperwork.

Why Drivers Need SR22

- Driving without insurance

- License suspension

- Serious violations

SR22 Cost Insights

The Haima 7X itself does not raise SR22 costs.

Rates depend on violation history.

Continuous coverage helps stabilize pricing.

Is No License Insurance Really Allowed in Texas?

Yes, under specific conditions.

The policy must list a licensed primary driver.

The vehicle owner can still be insured.

This is common for families and new residents.

Top Costly Mistakes Agents See Every Day

Cheap insurance becomes expensive when mistakes happen.

Choosing Limits That Are Too Low

Medical costs in Texas rise fast.

Low limits expose drivers financially.

Incorrect Driver Listings

Unlisted drivers can void claims.

This is critical for no-license setups.

Letting SR22 Coverage Lapse

Lapses can reset compliance periods.

This leads to higher long-term costs.

Why Local Texas Agencies Save Drivers Money

Texas insurance pricing varies by county.

Local agents understand carrier preferences.

This insight helps keep Haima 7X insurance affordable.

Where to Find Cheap Haima 7X Insurance Texas

Independent agencies compare multiple carriers.

They match coverage to driver profiles.

This avoids unnecessary add-ons.

View affordable Haima 7X insurance quotes in Texas

How to Keep Premiums Low Year After Year

Maintain continuous coverage.

Avoid payment lapses.

Ask about safe-driver discounts.

Review policies annually.

FAQ: Cheap Haima 7X Insurance Texas

Is the Haima 7X expensive to insure?

No, it is comparable to other family MPVs.

Does SR22 permanently raise rates?

No, rates often decrease after compliance.

Can I insure a Haima 7X without driving?

Yes, with a licensed primary driver listed.

What coverage is best for families?

Full coverage offers the most protection.