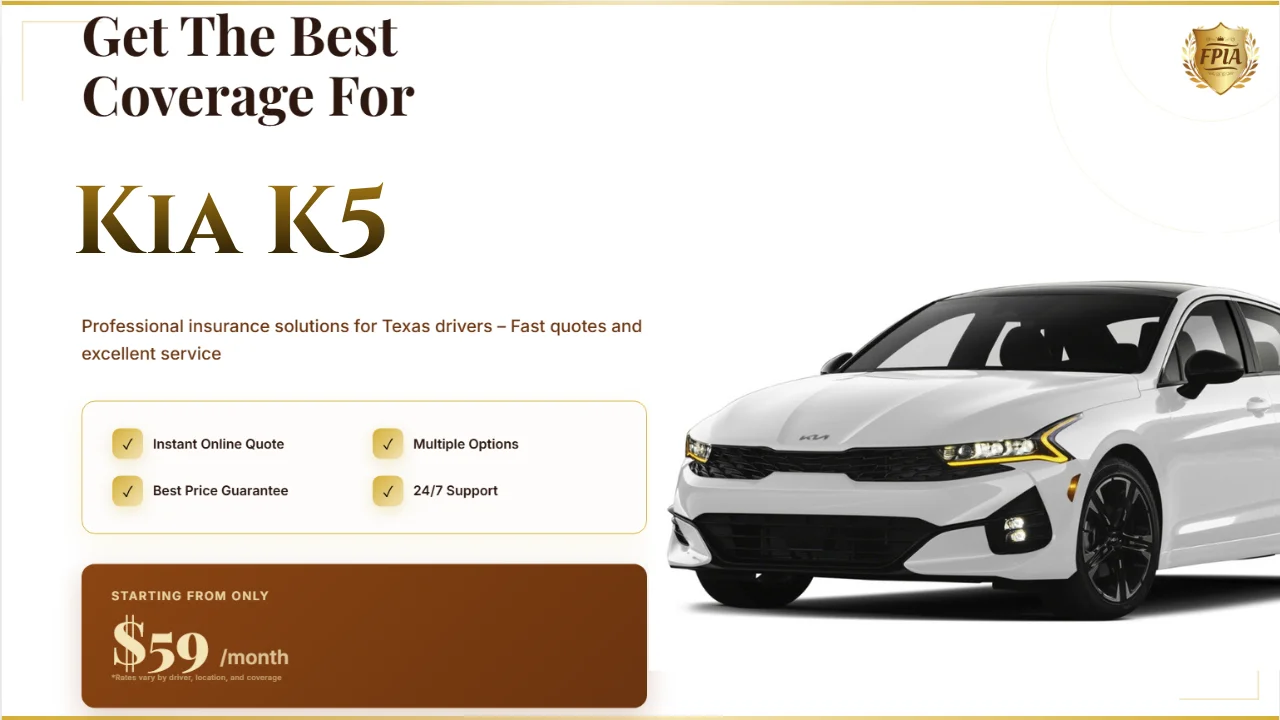

Cheap Kia K5 Insurance Texas: SR22 & No License OK

Published: January 28, 2026

Driving a Kia K5 across Texas highways can feel smooth and confident—until insurance becomes the problem. Many drivers only realize how complicated coverage can get after a ticket, a lapse, or a license issue. This guide is built for real Texas situations, focusing on affordable options, SR22 requirements, and solutions even if you currently don’t have a license.

Why Cheap Kia K5 Insurance in Texas Isn’t One-Size-Fits-All

Texas insurance rates vary heavily based on where and how you drive. Urban areas like Houston, Dallas, and San Antonio often see higher premiums due to traffic density and accident frequency. For Kia K5 owners, insurers also look closely at repair costs, theft statistics, and safety features.

If you’re dealing with SR22 filings or driving without a valid license, the situation becomes more specific. Many standard carriers quietly decline these cases. That’s why finding Cheap Kia K5 Insurance Texas requires working with agencies that understand high-risk and non-standard drivers.

Local knowledge matters. Texas weather, long commutes, and enforcement practices all influence how policies are priced and approved.

Step-by-Step: How to Get Insured With SR22 or No License

Many drivers assume SR22 or license issues mean automatic rejection. In reality, Texas law allows insurance as long as financial responsibility is proven correctly.

- Step 1: Identify whether you need SR22 for a ticket, accident, or court order.

- Step 2: Choose a provider that files SR22 electronically with the Texas Department of Public Safety.

- Step 3: If you don’t have a license, insure the vehicle as an excluded or named driver policy.

- Step 4: Select coverage limits that meet Texas minimums while staying affordable.

This structured approach keeps you legal while avoiding unnecessary add-ons that raise your premium.

Affordable Coverage Options for Kia K5 Owners

Different situations call for different policy structures. Below are common setups that help drivers lower costs while staying compliant.

SR22 Liability-Only Insurance

This is the most cost-effective option for drivers required to carry SR22. It meets legal requirements without paying for unnecessary coverage.

No License / Excluded Driver Policy

If you own a Kia K5 but don’t currently hold a valid license, insurers can still issue a policy with specific exclusions. This keeps the vehicle insured without violating underwriting rules.

Full Coverage With Flexible Payments

For newer Kia K5 models, full coverage may be required by lenders. Many Texas agencies offer monthly plans to reduce upfront costs.

Evaluation and Trusted Insurance Providers in Texas

Choosing the right agency matters as much as choosing the right policy. Look for Texas-licensed offices with experience in high-risk auto insurance.

Reputable providers explain SR22 timelines, confirm DPS filings, and help you avoid lapses that could reset penalties. A local office also understands regional pricing trends, which helps secure Cheap Kia K5 Insurance Texas without cutting legal corners.

View Cheap Kia K5 Insurance Quotes Here

Take Action and Get Covered Today

Delaying insurance can lead to fines, vehicle impoundment, or extended SR22 requirements. Getting covered now protects your Kia K5 and gets you back on Texas roads legally.

FAQ: Cheap Kia K5 Insurance Texas

Can I get Kia K5 insurance in Texas without a license?

Yes. Many insurers offer excluded or named driver policies that keep the vehicle insured legally.

How long do I need SR22 insurance in Texas?

Most SR22 requirements last two to three years, depending on the violation.

Is SR22 insurance expensive for a Kia K5?

Costs vary, but liability-only SR22 policies are often the cheapest option.

Will my rate go down after SR22 is removed?

In many cases, yes. Maintaining continuous coverage helps improve your pricing over time.