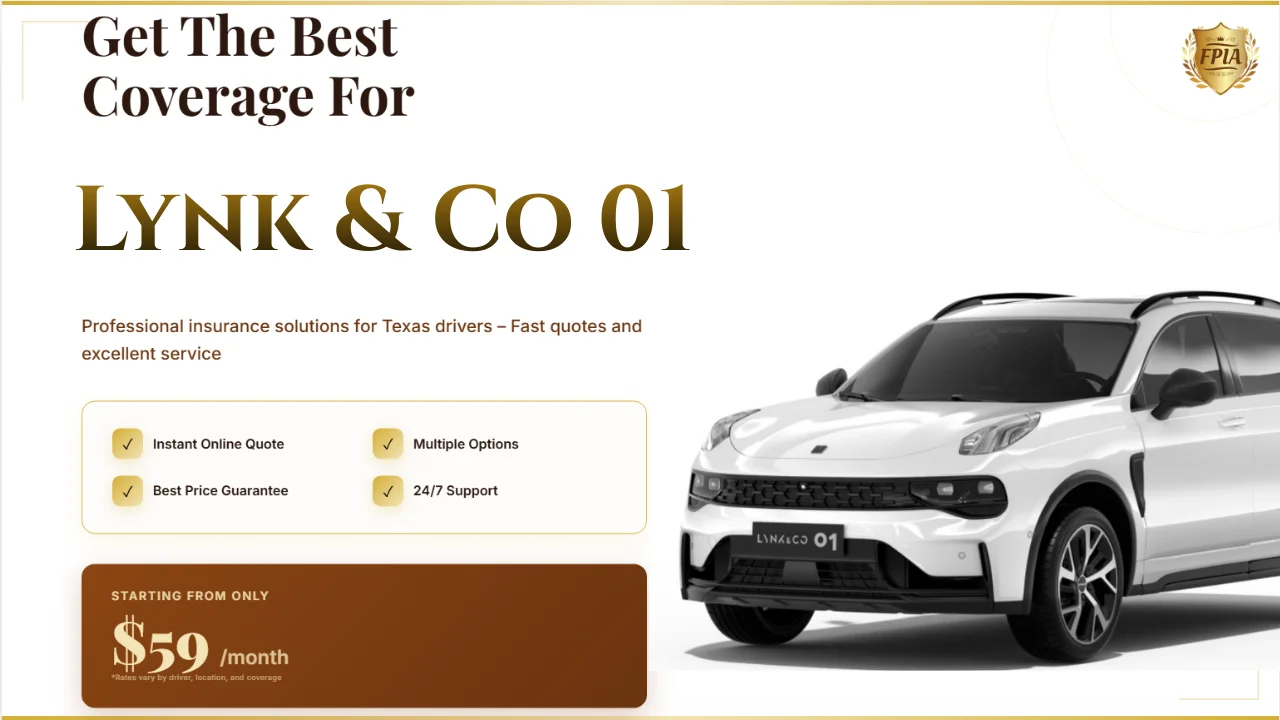

Cheap Lynk & Co 01 Insurance Texas: SR22 & No License OK

Published: January 28, 2026

People searching for Cheap Lynk & Co 01 Insurance Texas are usually dealing with more than just price. Many are facing SR22 requirements, no license situations, or prior coverage lapses that make quoting confusing and stressful. As a Texas insurance advisor, I see the same questions and costly mistakes repeated every week. This article breaks everything down in a clear, question-and-answer format while highlighting the most common pitfalls to avoid.

What Makes Lynk & Co 01 Insurance Unique in Texas?

The Lynk & Co 01 is still considered a low-volume vehicle in Texas.

Some insurers classify it as an imported or specialty model.

Repair cost assumptions can affect underwriting decisions.

Driver risk factors matter more than the vehicle badge.

Is Cheap Lynk & Co 01 Insurance Really Worth It?

Cheap policies often mean state minimum liability only.

Minimum coverage meets Texas legal requirements but offers limited protection.

Lower premiums usually come with higher deductibles.

Optional coverages like roadside assistance are often excluded.

How Does SR22 Insurance Apply to the Lynk & Co 01?

SR22 is a filing, not a separate insurance policy.

Texas requires SR22 after certain violations or suspensions.

Your insurer files proof of coverage with the state.

Any lapse restarts the SR22 compliance period.

Can You Insure a Lynk & Co 01 With No License in Texas?

Yes, no license insurance is possible when structured correctly.

A licensed primary driver must be listed on the policy.

The vehicle owner can be excluded from driving.

Incorrect driver listings can void coverage.

Five Costly Mistakes Lynk & Co 01 Drivers Should Avoid

- Buying minimum coverage without understanding exposure

- Letting an SR22 policy lapse for any reason

- Listing unlicensed drivers incorrectly

- Ignoring comprehensive coverage in hail-prone Texas areas

- Choosing price over insurer reliability

How Texas Driving Conditions Affect Your Insurance Cost

Urban congestion increases accident frequency.

Severe hailstorms raise comprehensive claim risks.

Flooding impacts low-clearance vehicles.

Uninsured driver rates remain higher than national averages.

Why a Licensed Texas Agency Matters

Texas-licensed agencies follow strict compliance rules.

They file SR22 documents accurately and on time.

They help prevent coverage gaps.

They explain real-world claim scenarios.

Where to Get a Reliable Lynk & Co 01 Insurance Quote

Automated quote tools often misclassify rare vehicles.

Local agents manually verify Lynk & Co models.

This avoids underwriting delays and cancellations.

View Lynk & Co 01 insurance quotes in Texas

CTA: Secure the Right Coverage Before It Costs More

Delaying proper coverage leads to fines and suspensions.

Fixing mistakes later always costs more.

Get insured correctly from the start.

FAQ: Cheap Lynk & Co 01 Insurance Texas

Is the Lynk & Co 01 expensive to insure in Texas?

Pricing depends more on driving history than vehicle brand.

Does SR22 insurance dramatically increase premiums?

SR22 adds cost, but affordable options still exist.

Can I insure my Lynk & Co 01 without a valid license?

Yes, when a licensed driver is properly assigned.

Is full coverage recommended for the Lynk & Co 01?

Yes, especially due to weather and repair costs.