Cheap MG3 Insurance Texas: SR22 & No License OK

Published: January 28, 2026

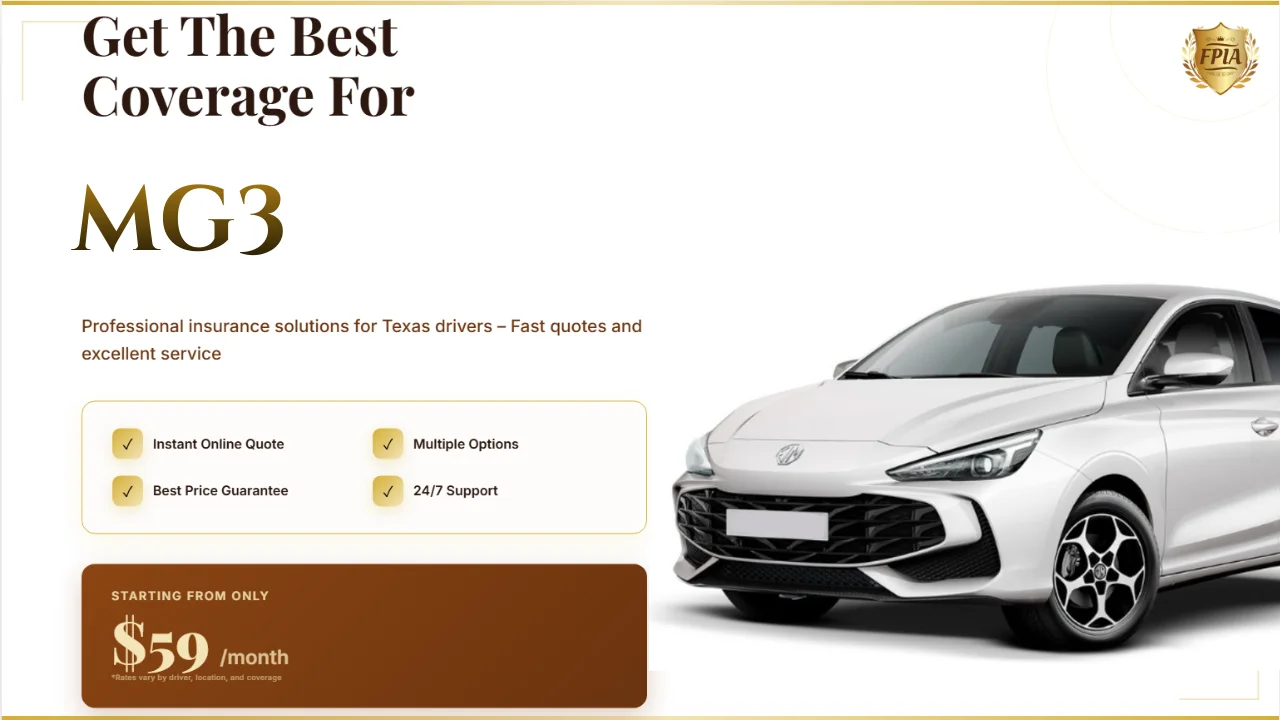

Searching for Cheap MG3 Insurance Texas usually starts with frustration. Many drivers ask the same hard questions: Is it even possible to insure an MG3 affordably in Texas? Does needing SR22 ruin every option? What if you do not currently have a valid driver’s license? These questions matter because Texas driving conditions, enforcement, and insurance rules can quickly turn a small mistake into a costly problem.

This guide uses a question-and-answer deep dive combined with a clear step-by-step action plan. It reflects how experienced Texas insurance agents actually help MG3 owners secure legal, functional, and cost-controlled coverage without cutting corners.

What Makes MG3 Insurance Confusing for Texas Drivers?

The MG3 is a compact, efficient vehicle that many drivers assume should be cheap to insure.

The confusion begins because MG models are less common in Texas databases.

Less familiarity creates uncertainty, not automatic high prices.

Insurers ultimately price risk based on drivers, not brand popularity.

Is Cheap MG3 Insurance Texas Really Achievable?

Yes, but cheap must be defined correctly.

Cheap does not mean bare-minimum coverage that collapses after one claim.

It means optimizing coverage to Texas risk patterns.

When structured properly, affordability and protection coexist.

Does the MG3 Cost More or Less to Insure Than Similar Cars?

The MG3 is categorized as a compact hatchback.

It is not considered high-performance or luxury.

Repair costs are generally moderate.

This places MG3 insurance in a competitive pricing range.

How Do Texas Driving Conditions Affect MG3 Insurance?

Texas highways involve long-distance, high-speed travel.

Urban congestion increases accident frequency.

Weather risks like hail and flooding drive comprehensive claims.

Insurance pricing reflects these realities more than the vehicle badge.

Step 1: Understanding SR22 for MG3 Owners in Texas

SR22 is one of the most misunderstood insurance requirements.

It is not a separate insurance policy.

It is a state-required filing proving financial responsibility.

The MG3 itself does not increase SR22 filing costs.

When Does Texas Require SR22?

SR22 is triggered by violations, not vehicle choice.

Common triggers include driving uninsured or license suspension.

The filing requirement follows the driver.

Can You Still Get Cheap MG3 Insurance Texas With SR22?

Yes, with the right carriers.

Not all insurers handle SR22 efficiently.

Specialized Texas agencies keep rates controlled.

Step 2: Insuring an MG3 Without a Driver’s License

This question comes up frequently.

Texas allows vehicle owners to insure cars without a license.

The policy must list a licensed primary driver.

Incorrect setup can invalidate coverage.

Why Do Insurers Allow No-License Policies?

Ownership and operation are legally separate.

Insurance protects financial liability.

As long as a licensed driver is listed, coverage remains valid.

Step 3: Choosing the Right Coverage Level for an MG3

This is where many drivers make costly mistakes.

Lowest price often equals highest future risk.

Texas accident costs escalate quickly.

Texas State Minimum Liability

This only satisfies legal requirements.

It offers minimal financial protection.

It is risky for daily drivers.

Liability Plus Comprehensive Coverage

This protects against theft and weather damage.

It is popular in hail-prone Texas regions.

Premiums remain affordable.

Full Coverage With Collision

This is ideal for financed MG3 vehicles.

Collision claims are covered regardless of fault.

Long-term financial exposure is reduced.

Step 4: Avoiding Common Mistakes With Cheap MG3 Insurance

Many drivers focus only on monthly price.

Low limits fail during serious accidents.

Uninsured motorist claims are common in Texas.

Short-term savings often lead to long-term loss.

Why a Licensed Texas Insurance Agency Matters

Licensed agencies understand Texas underwriting rules.

SR22 filings are submitted correctly and on time.

No-license situations are structured legally.

This ensures Cheap MG3 Insurance Texas actually works when needed.

Where to Get Reliable MG3 Insurance Quotes in Texas

Independent agencies compare multiple carriers.

They balance affordability with claim reliability.

Coverage is matched to Texas driving realities.

View MG3 insurance quotes in Texas

Next Actions for MG3 Owners

Review your driving record honestly.

Decide whether cheap means safe for your situation.

Choose coverage that survives real Texas accidents.

FAQ: Cheap MG3 Insurance Texas

Is MG3 insurance expensive in Texas?

No, it is typically comparable to other compact hatchbacks.

Does SR22 automatically increase MG3 insurance costs?

No, the driving violation determines the increase.

Can I insure an MG3 without a driver’s license?

Yes, if a licensed driver is properly listed.

What is the biggest mistake when buying cheap insurance?

Choosing limits that fail after one serious claim.