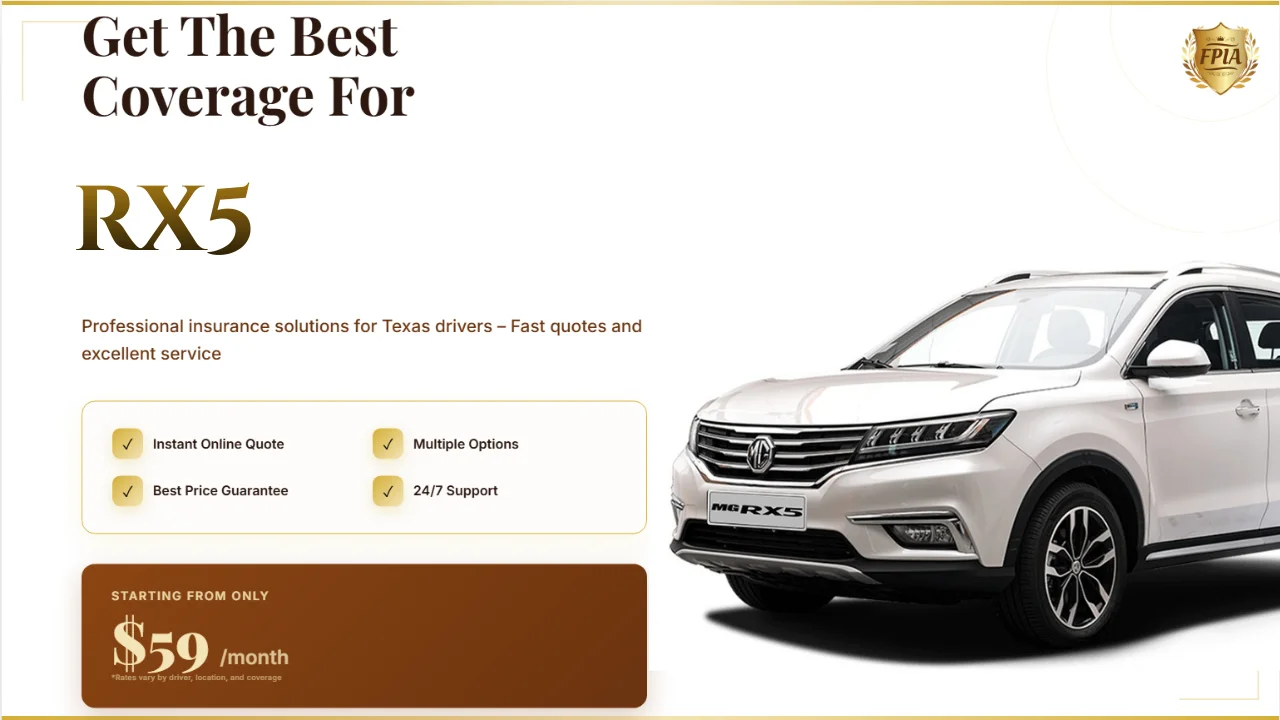

Cheap RX5 Insurance Texas: SR22 & No License OK

Published: January 28, 2026

Texas drivers searching for Cheap RX5 Insurance Texas usually feel pressure first, not curiosity. Rising premiums, SR22 requirements, or driving without a valid license create a sense of urgency. The problem is that Texas driving conditions, traffic density, and uninsured motorist rates can turn a cheap RX5 policy into a long-term financial headache if it is structured incorrectly.

The Real Problem With RX5 Insurance in Texas

The RX5 is often rated as a mid-size SUV with moderate repair costs.

Texas insurers price it lower than luxury SUVs.

However, Texas accident frequency raises claim exposure.

Cheap RX5 Insurance Texas often ignores this local risk.

Why Texas Driving Conditions Change RX5 Risk

Urban congestion in Houston, Dallas, and San Antonio increases collision rates.

Severe weather such as hail and flooding damages SUVs more often.

Long highway commutes raise mileage-based risk factors.

Ultra-cheap policies rarely account for these realities.

SR22 Insurance for RX5 Owners in Texas

SR22 is a financial responsibility filing, not a policy type.

It is required after violations such as DUI or no insurance.

The RX5 model itself does not increase SR22 cost.

Driver history remains the main pricing factor.

RX5 Insurance in Texas With No Driver’s License

Texas allows vehicle owners to insure a car without a license.

A licensed primary driver must be listed accurately.

Incorrect driver assignment is a common denial trigger.

Cheap RX5 Insurance Texas often cuts corners here.

Comparing RX5 Coverage Options for Texas Drivers

State Minimum Liability

This option meets Texas legal requirements.

It delivers the lowest monthly premium.

Out-of-pocket exposure remains extremely high.

Liability With Comprehensive Coverage

This protects against theft, hail, and vandalism.

It suits Texas weather risks well.

Costs stay relatively affordable.

Full Coverage With Collision

This is ideal for financed or newer RX5 vehicles.

Collision claims are covered regardless of fault.

Monthly premiums increase but risk is controlled.

Why Cheap RX5 Insurance Often Fails After an Accident

Low limits are exhausted quickly in multi-vehicle crashes.

Texas medical costs rise faster than minimum coverage.

Uninsured motorist claims are common.

Cheap policies rarely include strong protections.

The Advantage of Working With a Licensed Texas Agency

Licensed agencies understand Texas underwriting rules.

SR22 filings are submitted correctly and on time.

No-license policies are structured legally.

This keeps Cheap RX5 Insurance Texas valid when it matters.

Where to Get Reliable RX5 Insurance Quotes

Local agencies provide realistic pricing.

Coverage is matched to Texas driving risks.

Policy surprises are minimized.

View RX5 insurance quotes in Texas here

Next Steps for RX5 Owners in Texas

Review your driving record carefully.

Balance price against real financial exposure.

Choose coverage that survives Texas conditions.

FAQ: Cheap RX5 Insurance Texas

Is the RX5 expensive to insure in Texas?

No, it is usually rated as moderate risk.

Does SR22 insurance depend on the RX5 model?

No, SR22 cost is based on driving violations.

Can I insure an RX5 without a valid license?

Yes, if a licensed driver is properly listed.

What is the biggest risk of cheap RX5 insurance?

Insufficient coverage during serious accidents.