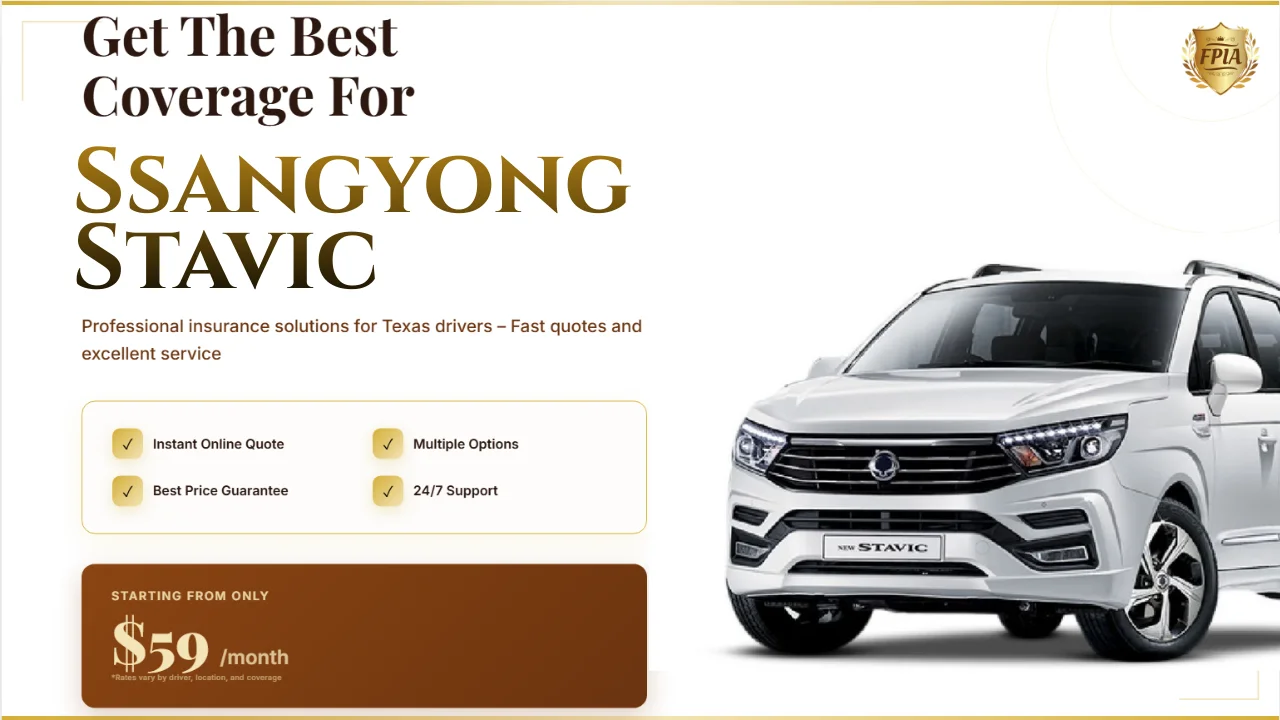

Cheap Ssangyong Stavic Insurance Texas: SR22 & No License OK

Published: January 28, 2026

Many Texas drivers searching for Cheap Ssangyong Stavic Insurance Texas assume that the lowest price automatically equals the best deal. As an insurance agent working with high-risk and non-traditional vehicles, I often have to play devil’s advocate. Cheap coverage can solve one problem while quietly creating three more, especially when SR22 filings or no-license situations are involved.

Why “Cheap” Ssangyong Stavic Insurance Can Be Misleading

Texas insurance pricing is driven by risk, not marketing terms.

The Ssangyong Stavic is categorized as a large MPV.

Vehicle size impacts liability exposure in accidents.

Ultra-low premiums often reduce critical protections.

What Texas Insurers Actually Look At

Insurance companies focus on driving history first.

SR22 status signals prior violations.

License status affects underwriting approval.

The vehicle itself plays a secondary role.

SR22 Insurance and the Ssangyong Stavic Explained

An SR22 is a certificate of financial responsibility.

It confirms compliance with Texas minimum liability laws.

The Ssangyong Stavic does not increase SR22 filing fees.

Accident and DUI history drive premium increases.

No Driver License: What Insurance Agents Won’t Tell You

Many assume no-license insurance is illegal.

Texas allows vehicle insurance without an active license.

A licensed driver must be listed on the policy.

Incorrect driver listings cause denied claims.

Coverage Options for Ssangyong Stavic Owners

Minimum Liability Only

This meets Texas legal requirements.

It offers the lowest monthly cost.

Financial exposure remains significant.

Liability Plus Comprehensive

This protects against theft and weather damage.

Texas hail and flooding make this practical.

Premiums stay relatively affordable.

Full Coverage With Collision

This suits financed or newer vehicles.

It covers at-fault accidents.

Monthly premiums increase accordingly.

Common Mistakes When Chasing Cheap Insurance

- Choosing state minimums without understanding risk.

- Failing to disclose SR22 requirements.

- Listing an unqualified primary driver.

- Assuming all insurers accept uncommon vehicles.

Why Local Texas Agents Matter More Than Price

Texas insurance regulations differ by carrier.

Local agents understand SR22 filing timelines.

They know which insurers accept no-license risks.

This prevents policy cancellations.

Where to Get Reliable Ssangyong Stavic Insurance Quotes

Accurate quotes depend on transparency.

Driver status must be disclosed.

SR22 needs should be confirmed upfront.

View detailed Ssangyong Stavic insurance quotes here

Smart Next Steps for Texas Ssangyong Stavic Drivers

Review your actual driving risk.

Balance price with financial protection.

Work with a licensed Texas agency.

FAQ: Cheap Ssangyong Stavic Insurance Texas

Is the Ssangyong Stavic expensive to insure in Texas?

It is generally comparable to other large MPVs.

Does SR22 insurance always cost more?

Costs depend on violation severity, not the vehicle.

Can I insure my Ssangyong Stavic without a license?

Yes, with a properly listed licensed driver.

What is the biggest mistake drivers make?

Prioritizing price over proper coverage.