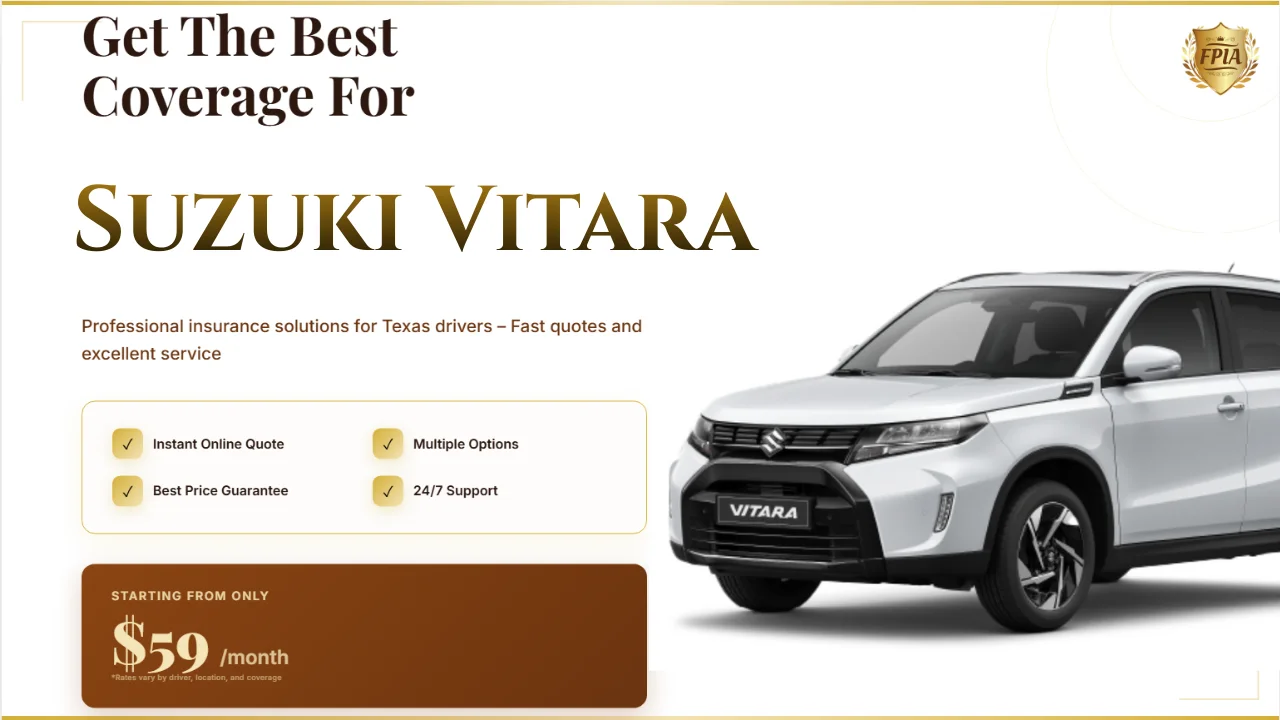

Cheap Suzuki Vitara Insurance Texas: SR22 & No License OK

Published: January 28, 2026

I still remember helping a first-time Suzuki Vitara driver in Houston who thought affordable coverage was impossible after a lapse in insurance. Between SR22 paperwork, license issues, and a tight budget, the stress was real. The good news is that Cheap Suzuki Vitara Insurance Texas is absolutely achievable when you understand how the system really works. This guide is written from an insider insurance agent’s perspective, focusing on real drivers who need practical solutions.

Why Suzuki Vitara Drivers in Texas Often Overpay for Insurance

Many Suzuki Vitara owners assume that limited brand presence in the U.S. automatically means higher insurance rates. In reality, the Vitara’s compact SUV classification and moderate engine size often qualify it for lower base premiums. The problem starts when drivers don’t know how insurers actually rate risk.

Texas insurance pricing heavily depends on driving history, zip code, and compliance status. If you need SR22 insurance in Texas or you’re driving without a license, many carriers quietly disqualify you before even giving a quote. This leads drivers to accept the first overpriced option they find.

An experienced local agent looks beyond the surface. We focus on carriers that accept non-standard drivers and still offer cheap auto insurance for Suzuki Vitara owners, even in high-risk situations.

SR22 and No License Insurance: What Actually Matters in Texas

One of the biggest misconceptions is that SR22 is a special type of insurance. In Texas, SR22 is simply a certificate proving you meet minimum liability requirements. The real challenge is finding a carrier willing to file it at a reasonable cost.

If you’re searching for Cheap Suzuki Vitara Insurance Texas SR22, the key factors are continuous coverage and correct filing. A single mistake in the SR22 filing can reset your compliance period and cost you hundreds more over time.

For drivers without a valid license, Texas still allows insurance options. You may need a named operator or excluded driver policy, depending on your situation. These policies are legal, compliant, and often far cheaper than drivers expect when structured correctly.

Best Coverage Options for Suzuki Vitara Owners on a Budget

Liability-Only Coverage

For older Suzuki Vitara models, liability-only insurance is often the smartest choice. It meets Texas legal requirements and keeps monthly costs low, especially for drivers needing SR22 filings.

State Minimum Plus Add-ons

Some drivers benefit from adding uninsured motorist protection or roadside assistance. These small add-ons can make a big difference without significantly increasing your premium.

Non-Owner Policies

If you drive a Suzuki Vitara but don’t own it, a non-owner policy can satisfy SR22 requirements and keep you legal on Texas roads. This option is often overlooked but extremely cost-effective.

Trusted Insurance Providers and Where to Get Real Quotes

Not all insurance agencies are created equal. Big-name companies often advertise low rates but quietly exclude high-risk drivers. Local Texas agencies specializing in non-standard auto insurance understand how to navigate SR22 filings and no-license cases.

At Fully Protected Insurance, we work with multiple carriers licensed by the Texas Department of Insurance. This allows us to compare options and find cheap Suzuki Vitara insurance in Texas that actually fits your situation, not just a generic profile.

View cheap Suzuki Vitara insurance quotes here

Take Action and Lower Your Suzuki Vitara Insurance Today

If you’re driving a Suzuki Vitara in Texas and dealing with SR22 requirements or license issues, waiting only makes it more expensive. The right policy keeps you legal, protected, and stress-free.

Get expert help from agents who deal with these cases daily and know how to cut unnecessary costs without risking compliance.

FAQ – Cheap Suzuki Vitara Insurance Texas

Is Suzuki Vitara insurance expensive in Texas?

No. Suzuki Vitara insurance is often affordable due to its safety profile and engine size, especially when matched with the right carrier.

Can I get SR22 insurance for a Suzuki Vitara?

Yes. Many Texas insurers offer SR22 filings for Suzuki Vitara drivers, including high-risk and budget-friendly options.

Is no license insurance legal in Texas?

Yes. Texas allows certain policies for drivers without a valid license, as long as they meet financial responsibility requirements.

How fast can SR22 insurance be filed?

In most cases, SR22 certificates can be filed electronically the same day your policy starts.