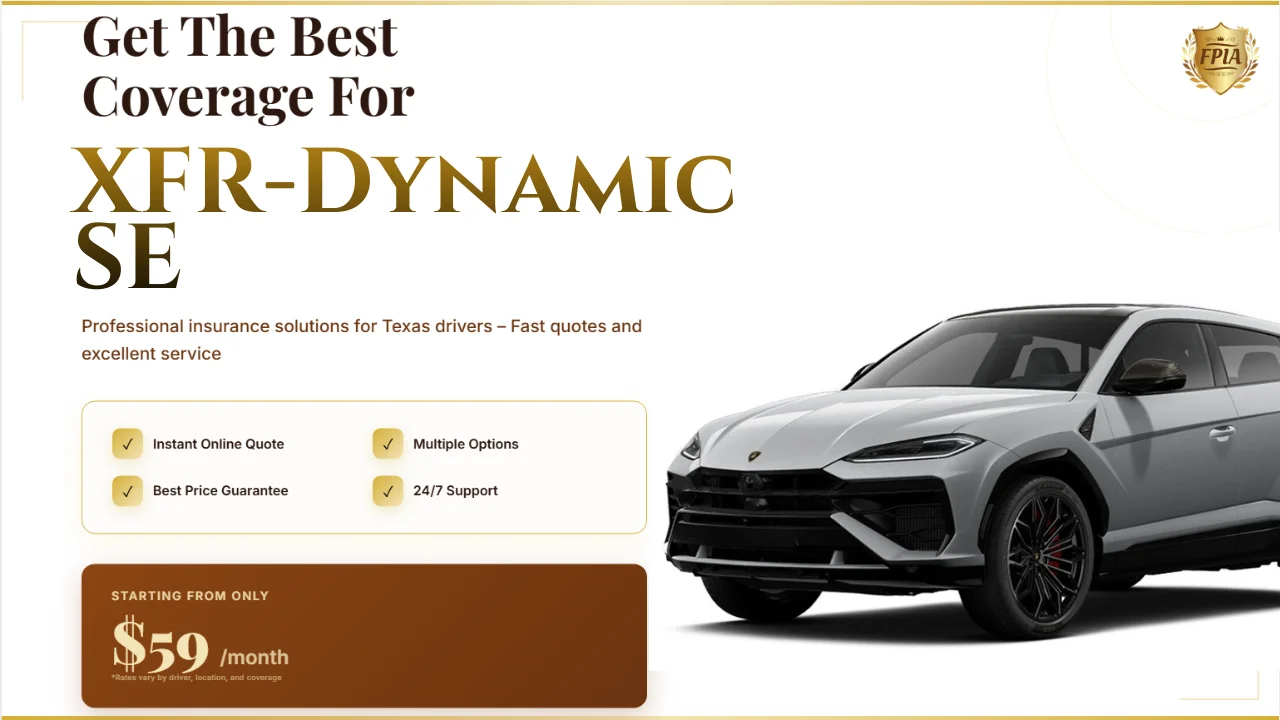

Cheap XFR-Dynamic SE Insurance Texas: SR22 & No License OK

Published: January 28, 2026

Many drivers searching for cheap XFR-Dynamic SE insurance in Texas ask the same hard questions: Is “cheap” really safe? Can I get insured with SR22? What if I have no license? These are valid concerns, especially when you’re trying to stay legal on Texas roads without overpaying. Below is a clear, step-by-step Q&A deep dive designed to help you make smart, compliant decisions instead of risky shortcuts.

What Does “Cheap XFR-Dynamic SE Insurance” Really Mean?

Cheap insurance usually means lower monthly premiums, but that reduction comes from somewhere. Insurers may increase deductibles, limit coverage types, or exclude certain risk scenarios. For XFR-Dynamic SE owners, this matters because performance-oriented vehicles are rated differently than standard sedans.

In Texas, the legal minimum only covers liability. That satisfies the law, but it does not protect your vehicle. Many drivers later realize that a cheap policy saved money upfront but cost far more after a claim.

The key is understanding what you are giving up in exchange for a lower price — and deciding if that trade-off actually fits your situation.

Can I Get XFR-Dynamic SE Insurance in Texas With SR22?

Yes, you can. Texas allows SR22 filings for qualifying drivers, including those with prior violations or license suspensions. However, not every insurer handles SR22 correctly.

SR22 is a filing requirement, not a type of insurance. A cheap policy that fails to file the SR22 accurately can cause serious legal trouble, including extended suspensions or fines.

Step-by-step, the correct approach is simple: choose a Texas-licensed insurer, confirm SR22 filing is included, and maintain continuous coverage for the full required period.

How Does No-License Insurance Work for XFR-Dynamic SE?

This is one of the most misunderstood topics in Texas auto insurance. You can insure a vehicle even if you do not currently hold a valid driver’s license, but the policy must be structured correctly.

Most no-license policies insure the vehicle and list a primary or excluded driver. Cheap online quotes often skip this detail, which can invalidate coverage.

The practical step is to work with an agency that understands no-license insurance and explains how the policy will be written before you pay.

Step-by-Step: How to Choose the Right Cheap Policy

- Step 1: Identify if you need SR22 or no-license coverage.

- Step 2: Decide between minimum liability or broader protection.

- Step 3: Compare deductibles, not just monthly price.

- Step 4: Confirm Texas licensing and compliance.

This process helps filter out policies that look cheap but fail when you actually need them.

Is Cheap Insurance Worth It for a Performance-Oriented Vehicle?

XFR-Dynamic SE models often carry higher repair costs. Cheap insurance may exclude collision or comprehensive coverage, leaving you fully exposed.

A balanced policy often costs slightly more but provides predictable protection. In practice, many Texas drivers find that “value-focused” insurance is safer than rock-bottom pricing.

The smartest move is to match coverage to how you actually use and store the vehicle.

Trusted Texas Providers and Where to Get Quotes

Reliable providers are licensed with the Texas Department of Insurance and experienced with SR22 and non-standard policies. They explain coverage clearly and submit filings correctly.

Instead of guessing, get a structured quote that reflects your real driving situation.

View detailed XFR-Dynamic SE insurance quotes here

Take Action: Get Covered Without Overpaying

Cheap XFR-Dynamic SE insurance in Texas works best when it is compliant, transparent, and matched to your needs. SR22 and no-license situations are manageable when handled correctly.

Take a few extra minutes to verify coverage details today and avoid costly surprises later.

FAQ: Cheap XFR-Dynamic SE Insurance Texas

Is SR22 insurance expensive for XFR-Dynamic SE?

It can cost more than standard policies, but pricing depends on your driving record and coverage choices.

Can I insure my car before reinstating my license?

Yes. Many Texas policies allow no-license setups when structured properly.

Does cheap insurance meet Texas legal requirements?

Only if it includes the state-required liability limits and proper filings.

What is the safest way to lower my insurance cost?

Compare multiple carriers, adjust deductibles carefully, and maintain continuous coverage.