Cheap Xiaomi SU7 Insurance Texas: SR22 & No License OK

Published: January 28, 2026

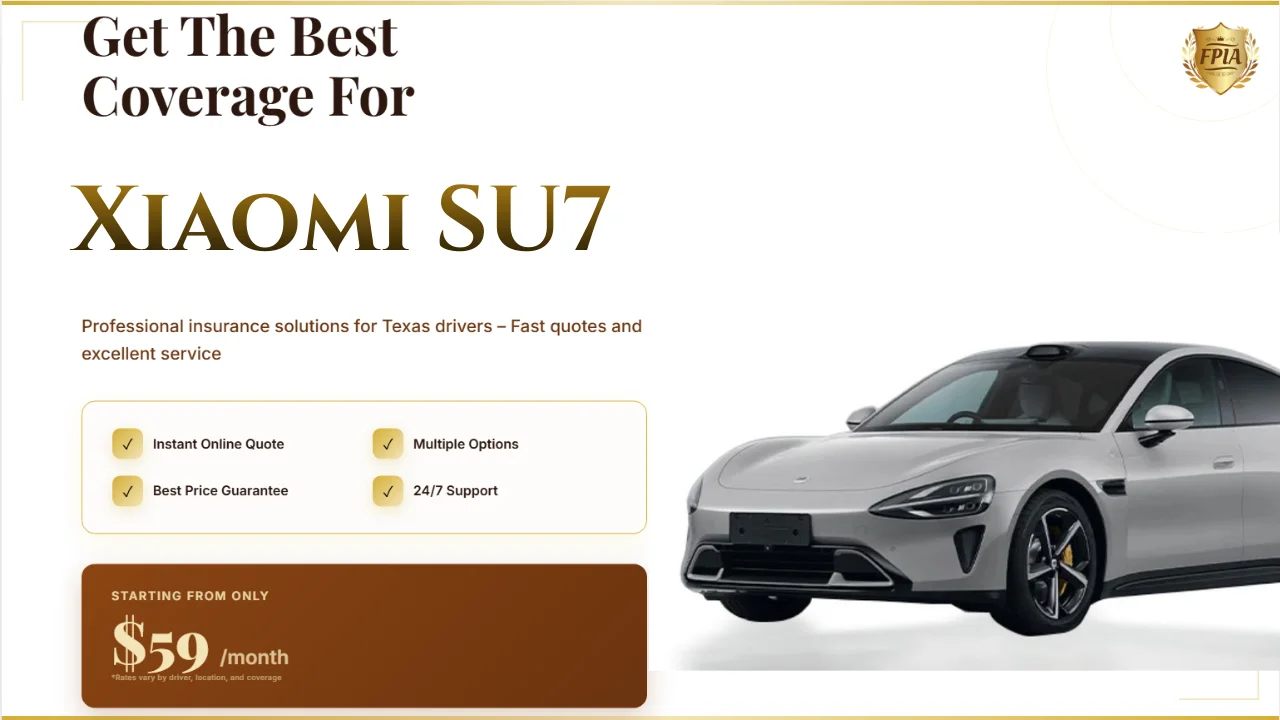

Cheap Xiaomi SU7 Insurance Texas sounds like a contradiction to many Texas drivers. The Xiaomi SU7 is a new electric performance sedan with cutting-edge technology, limited U.S. market history, and unfamiliar repair networks. Insurers in Texas price uncertainty aggressively. When SR22 filings or no license situations are added, choosing the cheapest option can quietly create long-term financial risk. Looking at both sides of “cheap” coverage helps avoid costly mistakes.

Why Cheap Xiaomi SU7 Insurance in Texas Is Not Always the Best Choice

The Xiaomi SU7 combines electric powertrain technology with high-performance output.

Texas insurers classify new EV models as higher uncertainty risks.

Limited U.S. claims history affects actuarial confidence.

Cheap policies often offset uncertainty by lowering coverage limits.

This creates exposure that outweighs short-term savings.

Pros and Cons of Insuring a Xiaomi SU7 in Texas

The SU7 offers strong safety systems and advanced driver assistance.

Those features can reduce accident frequency.

However, advanced sensors increase repair costs.

Battery-related claims remain expensive.

Texas insurers balance these factors conservatively.

SR22 Xiaomi SU7 Insurance: Balancing Compliance and Cost

SR22 is a Texas-required proof of financial responsibility.

It applies to the driver, not the vehicle model.

Electric vehicles do not reduce SR22 requirements.

Any lapse restarts the compliance timeline.

Cheap SR22 policies often fail due to missed payments.

SR22 Pros

- Allows legal driving after violations

- Maintains compliance with Texas rules

- Can be combined with standard coverage

SR22 Cons

- Higher base premiums

- Strict payment schedules

- No tolerance for coverage gaps

No License Xiaomi SU7 Insurance in Texas: Pros and Cons

Texas allows vehicle owners without a license to insure cars.

A licensed primary driver must be listed.

This structure keeps the policy valid.

Cheap insurers may misclassify drivers.

Misclassification increases claim denial risk.

Comparing Coverage Options for Xiaomi SU7 Owners

Minimum Liability Coverage

Lowest monthly premium.

Meets Texas legal requirements.

No protection for vehicle damage.

Liability Plus Comprehensive

Covers theft, fire, and weather events.

Important for hail-prone Texas regions.

Moderate pricing balance.

Full Coverage With Collision

Highest premium cost.

Protects advanced electronics and battery systems.

Best long-term financial protection.

Where Cheap Xiaomi SU7 Insurance Can Actually Work

Low annual mileage usage.

Garage-kept vehicles.

Experienced drivers with clean records.

Bundled multi-vehicle policies.

Careful structuring preserves value.

Choosing a Trusted Insurance Provider in Texas

Licensed Texas agencies understand EV underwriting.

They compare multiple carriers.

They handle SR22 filings correctly.

They structure no-license policies legally.

View Xiaomi SU7 insurance quotes in Texas

Actionable Steps to Reduce Xiaomi SU7 Insurance Costs

Maintain continuous coverage.

Choose deductibles strategically.

Limit annual mileage when possible.

Review coverage annually.

Disclose all drivers accurately.

FAQ: Cheap Xiaomi SU7 Insurance Texas

Is Xiaomi SU7 insurance expensive in Texas?

It is typically higher due to EV repair costs and limited claims history.

Does SR22 significantly increase SU7 insurance rates?

It raises premiums, but proper structuring controls long-term cost.

Can I insure a Xiaomi SU7 without a license?

Yes, with a licensed primary driver listed on the policy.

Is liability-only insurance safe for a Xiaomi SU7?

It meets legal requirements but carries high financial risk.