Ford Ranger 2.5 Insurance Cost in Texas: Compare Rates & Save

Published: January 28, 2026

In West Texas, a contractor named Luis depended on his Ford Ranger 2.5 every single day. The truck handled job sites, long highways, and unpredictable weather without complaint. The real frustration came later, when his insurance renewal arrived. The number looked higher than expected, and no one had explained why. Understanding Ford Ranger 2.5 insurance cost in Texas starts by looking at how this truck is actually used on Texas roads.

Why Ford Ranger 2.5 Insurance Cost in Texas Is Often Misjudged

Many drivers assume mid-size trucks are cheap to insure.

The Ford Ranger 2.5 sits in a higher utility risk category.

Texas insurers consider payload use and mileage patterns.

This leads to pricing surprises for new owners.

Texas Driving Conditions That Shape Insurance Pricing

Texas has some of the longest average commute distances.

Extended highway driving increases exposure time.

Rural roads bring higher animal-collision frequency.

Urban congestion raises low-speed accident claims.

The Problem: Choosing Coverage Based Only on Monthly Price

Low premiums look attractive at first glance.

Coverage limits are often quietly reduced.

Deductibles may be set unrealistically high.

Claims then become financially painful.

The Agitation: When Cheap Coverage Fails Texas Drivers

A single hailstorm can cause thousands in damage.

Uninsured drivers remain common in many counties.

Minimal policies shift risk back to the owner.

This is where regret usually begins.

The Solution: Building Smarter Ford Ranger 2.5 Coverage

Texas drivers benefit from balanced protection.

Coverage should match actual truck usage.

Small adjustments often reduce long-term cost.

Step 1: Accurately Define How You Use Your Ranger

Daily commuting creates predictable risk patterns.

Construction and trade use increase claim frequency.

Weekend hauling affects liability exposure.

Accurate usage classification prevents denied claims.

Step 2: Select Liability Limits That Protect Assets

Texas minimum liability rarely covers serious accidents.

Medical costs escalate faster than expected.

Higher limits protect savings and income.

The cost difference is often modest.

Step 3: Understand Core Coverage Options

Collision Coverage

This covers damage from at-fault accidents.

Essential for financed or newer Rangers.

Deductibles directly influence premium levels.

Comprehensive Coverage

This protects against hail, theft, and floods.

Texas weather makes this especially valuable.

Often underestimated until a major storm hits.

Uninsured and Underinsured Motorist Coverage

Texas has a significant uninsured driver population.

This coverage fills a critical protection gap.

Premium impact is usually minimal.

Step 4: Deductible Strategy That Actually Works

Higher deductibles lower monthly premiums.

Lower deductibles reduce post-accident stress.

Emergency savings should guide the decision.

There is no one-size-fits-all answer.

Step 5: Location Matters More Than Most Drivers Think

Houston and Dallas show higher collision frequency.

Rural West Texas sees more animal-related claims.

Flood-prone zones affect comprehensive pricing.

ZIP code accuracy directly affects quotes.

Pros and Cons of Budget-First Insurance Policies

- Lower upfront cost improves short-term cash flow.

- Coverage gaps increase long-term financial risk.

- Limited claims support causes delays.

- Often unsuitable for work-dependent trucks.

Why Local Texas Agencies Deliver Better Results

Local agents understand regional claim patterns.

They know which carriers favor mid-size trucks.

Policy customization becomes easier.

This often stabilizes Ford Ranger 2.5 insurance cost in Texas.

Common Mistakes Texas Ranger Owners Should Avoid

Buying minimum coverage without risk analysis.

Failing to update mileage or job usage.

Ignoring uninsured motorist protection.

Not reviewing policies at renewal time.

How Often Should You Compare Insurance Rates

Annual reviews prevent unnoticed price increases.

Clean driving records unlock better offers.

Market competition changes carrier pricing yearly.

Trusted Ways to Compare Ford Ranger 2.5 Insurance

Online tools provide fast initial comparisons.

Licensed agents verify real-world coverage terms.

Using both delivers the most accurate outcome.

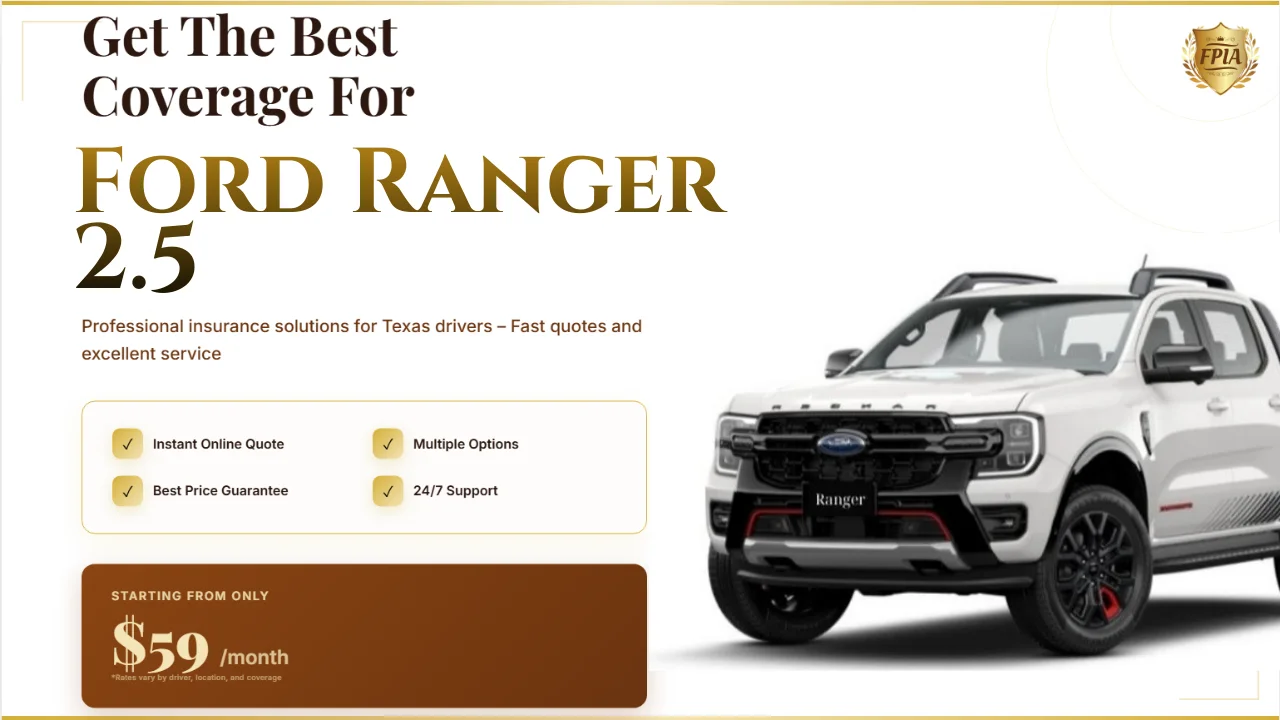

Compare Ford Ranger 2.5 insurance rates in Texas and find balanced coverage

CTA: Protect Your Ranger the Smart Way

Your Ford Ranger 2.5 supports your work and life.

Choose insurance that protects both.

FAQ: Ford Ranger 2.5 Insurance Cost in Texas

Is Ford Ranger 2.5 insurance expensive in Texas?

It is moderate but varies based on usage and location.

Does Texas weather really affect insurance pricing?

Yes, hail and flooding significantly impact claims.

Is minimum liability enough for a Ford Ranger 2.5?

Usually not, especially for work-related driving.

Should I use an online quote or an agent?

Combining both provides the most reliable comparison.